Business Bank Account Online – Whether you’re focused on sustaining commercial growth or your small business is just getting started, we can help you find the right checking account for your needs. All our business and commercial members enjoy features such as free online banking and free remote deposit collection.

The perfect checking account for your small business, club or non-profit organization. Avoiding monthly fees is easy with low monthly balance requirements. Put more money into your business with other great features like free online banking, free ACH products and free Visa® debit cards.

Business Bank Account Online

Enjoy all the free features of standard business checking, plus higher transaction limits, while earning dividends on balances of $5,000 or more.

Best Online Business Bank Accounts 2022

Speak to a member of our Business Services team or visit any location to learn more about business accounts. Don’t forget to review the list of required documents.

Get near-real-time updates on your Visa® card activity with Visa-powered alerts. So you can take quick action to reduce fraud and monitor your account from anywhere. Free for Visa® cardholders. Sign up at Visa.com/PurchaseAlerts.

Whatever you call it, we can probably save you some money. Merchant services are readily available by accepting Visa®, MasterCard®, American Express® and Discover® credit and debit cards. We have partnered with the industry leader in electronic payment processing to increase your profits and grow your business.

Open A Small Business Checking Account Online

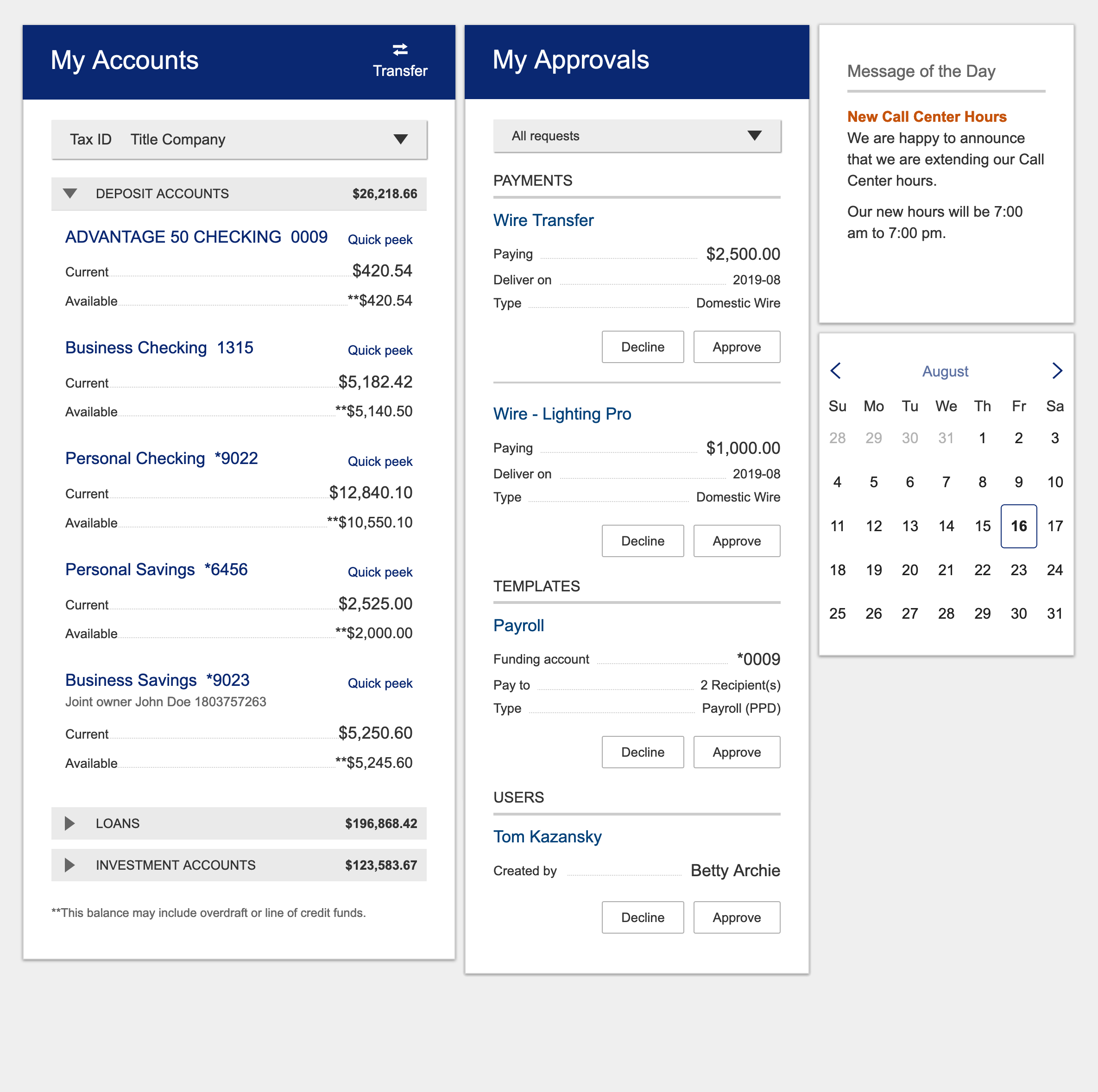

We know you don’t always have time to do banking during normal business hours. Our Business Online Account gives you free, anytime access to banking and bill payments, self-service account management, ACH payroll services and more. Check out the demo to the right!

Sign up today and get the resources and tools you need to succeed. Contact our business team to get started today!

The extension will leave the main location. Although you may click on a link that will take you to the websites of other companies with whom we have partnered, we are not responsible for the accuracy, security or content of their websites. We recommend that you review the privacy and security statements of all websites you visit No matter what business you are in, maximizing profits is a priority. Now that online banking has gone mainstream, opening a business account is easier than ever.

How To Open An Overseas Bank Account Online And A Foreign Bank Account In The Usa?

More and more banks are offering online banking solutions, making opening a business bank account online faster and easier than ever This step-by-step guide will show you how to open your new business account in no time!

Before you start browsing online banks, it’s important to gather all the documents you need to apply for an account.

Also, by organizing your paperwork early, you can determine in advance if there are documents that need to be collected. Ultimately, the documents you need will depend on the type of business you run.

What Are The Benefits Of An Online Only Business Bank Account?

Although some online banks, such as Novo, generally do not require documents from sole traders, the personal information that all banks require includes your Tax Identification Number (TIN) or Social Security Number (SSN), your physical address, telephone number, email address and your ID.

If your bank of choice requires additional business documents, these are usually your DBA (Doing Business As) certificate if you have registered a business name and an IRS Form SS-4 or Letter 147c verifying your Employment Identification Number.

To open an LLC business bank account, you must provide basic information, which includes your legal business name, the physical address and telephone number of your business registered with the Secretary of State, and an Employer Identification Number (EIN) issued by the IRS. . You may also need to enter the date your business was established.

Expired] U.s. Bank $400 Business Checking Bonus

Although not always required, some banks may ask you to disclose your annual income, so make sure you have this information to hand. Additional documents that may be required for further verification are the Company Statute and the employment contract

As a corporation, many of the business details provided during the application are the same or similar to an LLC. This includes the company’s legal name, physical address and telephone number registered with the Secretary of State.

You must provide your Employer Identification Number (EIN). Unlike other types of businesses, you cannot enter a Social Security number or other identifier instead of an EIN.

Get A Business Lending Platform Demo

Other documents provided by online banks include the company’s articles of incorporation and bylaws.

As with a sole trader, you must provide your full name, physical address, phone number, email address and Social Security Number (SSN).

For further validation, you may need to submit a copy of the partnership agreement as well as the partnership certificate. The partnership agreement should detail the division of ownership between the partners and the distribution of profits and losses.

Best Online Business Bank Accounts You Need In 2023

Once you have all your documents ready, it’s time to decide which type of bank account is ideal for you. A lot depends on the activities you want to do on your account and your financial goals

If you need to regularly deal with banking transactions, such as check and cash deposits, ATM withdrawals, ACH and wire transfers, and debit card purchases, then a business checking account is right for you.

The most versatile type of business account, the checking account makes it easy to manage the day-to-day finances of your business.

Get A Massage Business Bank Account For Free

A big advantage of business invoices is that they often come with accounting software and other digital tools to help you optimize your business finances.

If you’re looking for an account that allows you to accumulate as much business savings as possible without making regular transactions, you may want to consider a savings account.

These bank accounts have higher interest rates than checking accounts, but they aren’t prepared to handle large amounts, meaning you may pay higher fees if you transfer and withdraw excessive amounts.

Business Online & Mobile

Although this type of account earns more interest than a basic savings account, you probably won’t be able to withdraw the money for a while.

As a result, a certificate of deposit (CD) account is best for businesses that want to accumulate savings from additional sources that they don’t need to use for the day-to-day operations of their business.

If you run a business that accepts credit and debit card payments from customers, you may need a merchant account.

Information Reporting & Recordkeeping

However, it is important to note that although this account has its own fees, you will need to open a checking account before the trading account because you will need a bank account to transfer the money after you deposit it into the trading account. .

Given that these include monthly fees and card transaction fees, you should think carefully about whether it’s worth it before opening a merchant account.

Once you know which bank account you’re looking for, it’s time to compare banks. Above all, you’ll want to choose a bank that offers the best deal for your specific business banking goals, whether it’s paying low fees, high interest rates, using digital funds or accessing credit.

Steps To Opening A Business Bank Account For Your Llc

There are many online banking options available, from banks that have online banking services like Bank of America and Chase to online-only banks like BlueVine. If you’re a small business owner, there are also banks that focus on serving sole traders, freelancers and other types of small businesses, such as Lilly and Novo.

Once you know which bank you want to join, visit the official website of your desired bank.

Most online banks allow you to apply for a bank account within minutes from the home page of their website.

How Do You Open An International Business Bank Account?

Banks like BlueVine, Lilly and Found pride themselves on letting you open a bank account and get started in minutes.

Once you’ve successfully completed your application and activated your bank account, it’s time to start your financial journey!

Make sure you put money into your account to start saving and familiarize yourself with your bank’s online portal and the digital tools available to start optimizing your business finances.

Open A Small Business Account

Also consider downloading your bank’s mobile banking app to track your financial activity on the go.

There are many online accounts that you can choose from so that you can find them

Online international business bank account, online business bank account usa, online small business bank account, best online business bank account, online business bank account, easy business bank account online, online only business bank account, free online business bank account, apply online business bank account, open business bank account online, chase business bank account online, instant online business bank account