Business General Liability Insurance – General liability (GL) coverage protects against lawsuits and other claims arising from your actions. Also known as business liability insurance, it covers a variety of risks that small business owners may face, including:

Progressive Commercial’s general liability insurance includes a variety of coverages to protect you from claims against your business.

Business General Liability Insurance

:max_bytes(150000):strip_icc()/Commercial-General-Liability-Final-51e0c0f9b27d4e409a7f49da59fbe037.jpg?strip=all)

For example, if a customer slips or is injured by a falling object on your premises, your business will receive personal injury coverage.

What Does Commercial General Liability (cgl) Insurance Cover?

Coverage also includes Aggravated Damage Protection (covers you for damage to someone else’s property while you’re at work) and Product Claims Protection (covers you in the event of a product death or personal injury).

Personal injury and advertising injury insurance, protecting you from claims related to libel, slander or copyright infringement.

The amount of general liability insurance your business needs depends on factors such as your company’s goals and contractual requirements.

The Ultimate Guide To General Liability Insurance

Commercial liability policies are suitable for businesses that deal with customers, sell products, advertise, etc. Although not required by law, general liability is a type of business entity that protects you from a variety of claims and lawsuits by third parties.

Sometimes, employers and clients may ask you to provide some credit before working for them. Read your policy carefully to make sure you select the correct limits when getting liability premiums.

Contractors typically require some form of commercial liability insurance to protect them from risks that may arise on the job. Matching liability coverage to your report can provide you with peace of mind in the event of an unexpected lawsuit.

General Liability Insurance Vs. Business Owner’s Policies: What’s The Difference?

For example, if a pedestrian runs over equipment left by a landscaping company on the road, their liability insurance may cover their medical bills and the business’s legal fees.

You can purchase general liability insurance through a Progressive Advantage® business plan. We can also help qualified contractors obtain general supplemental coverage to extend your liability coverage to other entities. Some contracts with employers require this general liability agreement.

Through 2022, the national median price for general liability insurance offered by Progressive is $53 per month. The average price is $72.

What Is General Liability Insurance And Why Do Businesses Need It?

As average costs increase, most consumers will find their monthly costs getting closer to the median cost. Your price will depend on specific aspects of your business, such as your industry and number of employees.

Learn more about general liability insurance pricing and learn money-saving tips to help you find the best balance between affordability and business protection. Call us or chat online for our liability policy.

If you own a business or are retired, a Business Owners Policy (BOP) that combines liability and property coverage is best for your company.

General Liability Insurance Vs. Business Owners Policy

Small and medium-sized businesses such as restaurants and grocery stores should consider additional protections included in the balance of payments.

No, but not offering general liability coverage will leave you liable for all costs associated with claims against your business. For example, while visiting your office, a customer slips on the carpet and breaks his hip. Without general liability insurance, you may be solely responsible for medical bills and legal fees. So even if it’s not legal, it should be a priority for your business.

Yes. The amount of the liability credit you choose to deduct when you receive payment. A deductible is the amount of out-of-pocket expenses you agree to pay before you start paying.

What Is Commercial General Liability?

Liability insurance only pays for the third party’s losses, not yours. They call you “the first team.” “Third Party” means the person who has a claim against you. This means that general liability will not cover you if your property or equipment is stolen or damaged.

To protect your property, we offer business property insurance as part of a business owner’s policy.

Yes. Because liability expenses are considered “business expenses,” they are generally tax deductible. That said, it’s best to consult a tax professional to find out.

What Insurance Coverage Should Independent Contractors Carry?

No. General liability only covers claims brought by others against you for personal injury or property damage. To protect yourself against claims for negligence or malpractice, you should take out professional indemnity insurance.

A Certificate of Insurance (COI) is a formal document that lists all coverages and limits in an insurance policy. Most importantly, proof that you have insurance and information about your policy’s coverage and limits.

Yes. Progressive can help you purchase business insurance, including general liability insurance, in all states except Hawaii. Browse by state.

General Liability Insurance Texas

Yes. High-risk businesses can obtain general liability insurance in a separate market called excess and surplus (E&S) insurance. E&S Insurance provides coverage to businesses not covered by the standard market.

It depends. Although not required by law, an LLC may require general liability insurance to perform certain contracts, such as leases. However, it is best to have a general liability insurance policy to protect against expensive lawsuits and claims against your business What is general liability insurance? Industrial Liability Insurance (CGL) is a type of commercial insurance designed to cover you against third party claims arising from personal injury, property damage, personal injury or litigation. Most general liability insurance policies in Oklahoma (OKC) and nationwide are very broad and cover some of the following risks:

Most small businesses in Oklahoma and across the country require general liability insurance. If you rent, own an office or business premises, the business may require or provide coverage under a Commercial General Liability (CGL) policy. In fact, one of the first steps a small business takes when setting up shop is to purchase CGL to protect the foundation of their business.

General Liability Insurance For Contractors

The amount in the contract will vary depending on the type of business you have. Property type presentation is determined by location, services and construction are determined by sales or price. Each policy has a page detailing your exposures and codes, the basis of your premium, and the exposure used to determine your premium. You should check them to make sure they are correct.

General liability insurance limits will vary whether you live in Oklahoma City (OKC) or another state, but typical limits are $1,000,000 per accident. General liability insurance consists of one or more “bundles,” which are the maximum amount the policy will pay for that type of coverage in a year.

The standard policies are “Completed Products and Services” and “Claims Other than Completed Products and Services.” If you want more than $1 or $2 million in liability coverage, you should purchase commercial umbrella or general liability insurance.

Protecting Your Business

Endorsements are used to modify a standard liability insurance policy. Some endorsements expand coverage, while others limit coverage. These can be used to tailor general liability coverage to your type of business. Some common types of insurance include: General liability insurance can help protect your small business from claims from others for personal injury or property damage. Without general liability coverage, you may have to pay for these claims out of pocket. General liability insurance (GLI) can go by a number of different names, such as commercial liability insurance, commercial general liability insurance, or general liability insurance (CGL).

On average, liability insurance in The Hartford costs $67 per month, or about $805 per year. 1 Keep in mind that general liability insurance costs are different for everyone because every business is unique. Factors that determine this cost include:

Did you know that 4 in 10 small business owners will face a property or general liability claim within the next 10 years?

The Difference Between General Liability And Professional Liability

Claims range from accidents, such as theft, to accidents, such as a customer being injured after a slip and fall.

Liability insurance protects you from expensive liability claims that arise under normal business circumstances, such as:

You may need this coverage if required by your dealer. Many consumers want to confirm that you have general liability insurance before signing a contract with your business. You can show that you have general liability insurance and proof of liability insurance.

General Liability Product Model

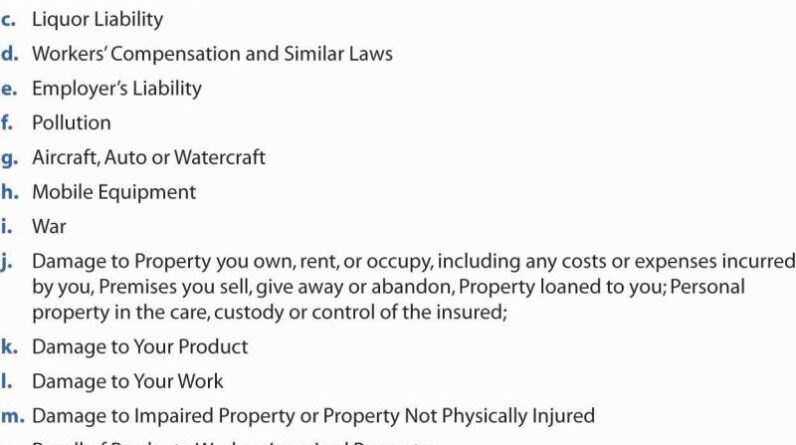

General liability insurance does not cover all types of claims. Depending on your small business, you may need different types of insurance to protect your business. A general liability insurance policy does not cover commercial vehicle accidents, employee injury or death, damage to your business property, professional errors or omissions, errors or illegal activity, or any claim that may exceed your credit limit. It also doesn’t cover claims related to a data breach or loss of revenue if your business is unable to open due to damage to assets.

State law does not require business owners to purchase liability insurance. But it’s still a good idea to have this kind of liability coverage. If a customer sues your business and you are uninsured, your business finances and personal assets may be at risk.

It’s important to understand the scope of your government

Cheap General Contractor Insurance

General liability insurance for lawn care business, general liability insurance colorado small business, general liability business insurance quotes, general liability insurance for business cost, cheapest general liability insurance small business, allstate general liability insurance small business, geico general liability business insurance, general liability insurance small business, general liability insurance cost for small business, cheap general liability business insurance, liberty mutual general liability business insurance, general liability insurance coverage for small business